Everytime you can estimate that the Expense advantage will probably be favourable, a plan loan is usually desirable. Take into account that this calculation ignores any tax effects, that may improve the plan loan's benefit because shopper loan fascination is repaid with right after-tax bucks.

Before you decide to take out a 401(k) loan, it’s important to know the pluses and minuses—and achievable alternatives—so you may make an educated borrowing determination.

"In case you can make an effort to preplan, set financial aims for yourself, and commit to preserving several of your money both of those generally and early, you could obtain you have the cash accessible to you in an account aside from your 401(k), thus preventing the necessity to take a 401(k) loan."

Dave Ramsey’s Baby Measures have aided millions of individuals help you save for emergencies, pay off financial debt the moment and for all, and Establish wealth—and they will work for you also!

Another difficulty Together with the poor-effect-on-investments reasoning is the fact it has a tendency to assume the exact same rate of return over the years; having said that, the stock current market doesn't perform like that. A expansion-oriented portfolio which is weighted towards equities will have ups and downs, especially in the temporary.

And, even though withdrawing and repaying inside of five years might have minimum impact on your retirement price savings, the impression of a loan that must be paid again around many years could be substantial.

needs that the approach’s Demise benefit be paid out in total to the surviving spouse (Except the wife or husband has consented to another beneficiary);

We may possibly make income from backlinks on this page, but commission would not affect what we generate or even the products and solutions we endorse. AOL upholds a rigorous editorial system to guarantee what we publish is fair, precise and trusted.

six Do you see the problem below? You could be content at your career now, but what about a year from now? Or two years from now? In this article’s the bottom line: Debt boundaries your ability to choose. In addition to a 401(k) loan can depart you feeling tied fiscally in your occupation . . . Even when you desperately want to leave or have an thrilling career opportunity before you. Don’t give your manager that kind of ability in excess of you. three. You end up shelling out taxes with your loan repayments—twice.

Available via nonprofit credit score counseling companies, DMPs are made to reduce your interest fees and consolidate payments with no getting a loan, giving a structured prepare for receiving from debt.

The underside Line Arguments that 401(k) loans are poor for retirement accounts generally suppose constantly solid stock market place returns during the 401(k) portfolio, and so they are unsuccessful to think about the fascination cost of borrowing related quantities by way of a bank or other consumer loans (for example racking up charge card balances).

This strategy consists of a legitimate financial debt settlement firm or law firm negotiating with your creditors to accept fewer than the entire amount owed. But this selection comes with large charges and major risks for your credit — and also likely lawsuits from your creditors.

Downsides: If you leave your present-day career, You may have to repay your loan in complete in website a very small timeframe. But If you cannot repay the loan for almost any reason, it's regarded as defaulted, and you'll owe both equally taxes plus a 10% penalty about the exceptional equilibrium in the loan if you're underneath 59½.

Let us analyze when these aspects could create economical challenges for borrowers And the way they can be averted.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Heath Ledger Then & Now!

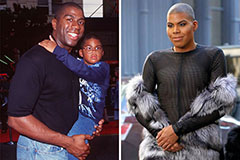

Heath Ledger Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!